EUR/CHF has been in a bear trend since September 18, 2021. Currently, the exchange rate is sitting at 1.0798. The Swiss franc is poised to strengthen further against the euro. A low 2 sell signal is setting up. Once triggered EUR/CHF will continue its slide to 1.0730.

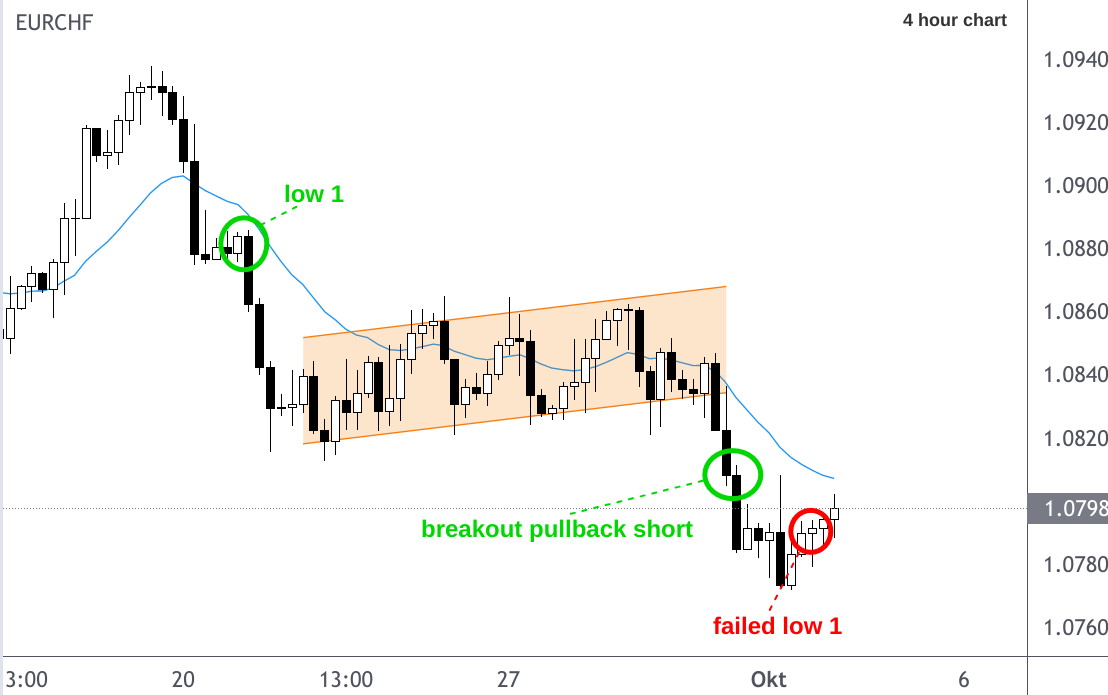

The first push down from September 18 to September 20 was very strong. EUR/CHF plummeted from 1.0940 to 1.0875. Thereafter, a small pullback formed a low 1. That sell signal was triggered September 21, 2am EST and pushed the exchange rate down to 1.0815.

A trading range dominated trading the remainder of the month. That trading range was sloping upward and it was therefore a channel and also a wedge. The wedge had three pushes up. After the third push up a strong bearish reversal bar formed.

It was a risky trade to go short 1 pip below the low of that reversal bar. The bottom of the channel was too close, the stop loss at 1 pip above the bar's high too wide. Potential profit times winning probability was lower than potential loss times losing probability.

September 30, 6am EST the market broke out of the wedge and continued the bear trend. After the breakout bar there was a strong pullback. The bulls tried to get EUR/CHF back into the trading range. They failed. The bar after the breakout closed near its low, setting up a very good signal for a breakout pullback short trade.

Sell stop entry was at 1.0804, protective stop loss at 1.0837. The next bar was a strong bear bar. EUR/CHF fell to 1.0784. Shortseller got invited to take partial profits and lowering their stop to breakeven. That breakeven stop was triggered October 1, 6pm EST. Subsequently, the market fell to a new low at 1.0770

October 4, 3am EST EUR/CHF is sitting at 1.08. The first attempt of the bears to get the market back into bearish mode failed. Unlike the low 1 from September 21 the low 1 from Oktober 3, 6pm EST was very weak. There was no strong bearish momentum preceding.

Currently, the bears are waiting for of the second leg up to complete and a low 2 setup near the moving average. EUR/CHF should then fall towards 1.0730 by October, 6. Depending on the height of the reversal bar this could be an excellent trade, having a winning probability of 60% and reward up to three times risk.